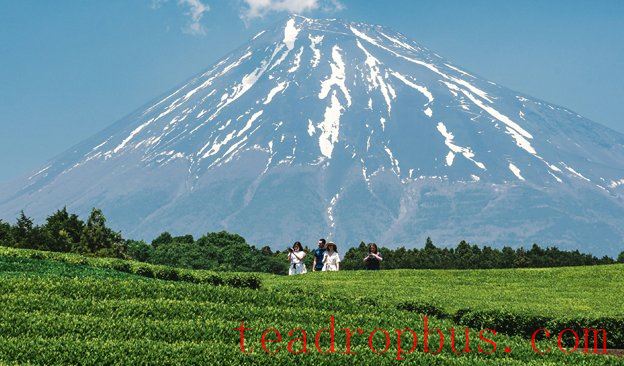

Since 2021, Japanese green tea exports have been steadily increasing, and Japan now ranks as one of the highest-value tea exporters in the world. Photo credit: Andreas Rasmussen

A century ago, half of the tea exported from Japan was sent to American homes and restaurants, imported under familiar brand names like Folger’s Green Tea in vacuum tins. Demand plummeted in the decade leading up to World War II and persisted through 1950 due to anti-Japanese sentiment and geopolitical factors that resulted in steep tariffs starting in 1930.

During the pandemic years, Japanese green tea once again became a popular choice among American buyers, who purchased half of the tea exported by Japan in 2021 and the majority of tea by value every year since. In 2024, Japan’s average unit price of $27.30 per kilogram was the highest among the 15 countries exporting high-value tea.

Orders are now on hold as Japan faces a potential 24% US tariff starting July 9 unless it reaches a trade agreement with the Trump administration.

“There are no immediate, easy options,” says QTrade Teas & Botanicals CEO Manjiv Jayakumar. The Houston-based tea blender advises clients to remain open-minded when considering multi-origin blends, given the risks associated with tariffs. Tea sourced from China faces a tariff of at least 37.5%, while duties on Indian teas may rise by 26%, those from Taiwan by 32%, and 44% from Sri Lanka. On July 9, duties on tea imported from Thailand could jump to 36%, and Vietnam’s tea tariffs could increase by as much as 46%.

Buyers who rushed to secure tea before the tariffs were enforced must now wait and see, as transit takes 30 to 45 days. Tea at sea is subject to high tariffs upon entry at the port, and since that rate is uncertain, the risk for buyers shipping tea from Japan is significant.

Japan’s Prime Minister Shigeru Ishiba stated he won’t hurry into a compromise. “We may fail if we rush, and I don’t think it’s good to compromise a lot in order to just get the negotiations done,” Ishiba said, making it likely that duties on imported tea will increase from 10% to 24%.

Japan is the world’s sixth-largest tea exporter by value, generating $242.5 million in sales in 2024. Record sales marked a decade of growth that began in 2005, when tea exports rose from 2.1 billion yen to 6.6 billion yen in 2014, a period when domestic consumption declined.

Japan currently accounts for 3.2% of the world’s tea exports by value and was the second-fastest-growing tea exporter from 2023 to 2024, with a growth rate of 15.1%, just behind India at 15.5%.

Americans Once Favored Green Tea Over Black

Between 1880 and 1930, Japan exported approximately 500,000 metric tons of green tea to the United States. Annual tea exports averaged between 18,000 and 20,000 metric tons during the 1920s, making up more than 90% of the US's tea imports by volume. The surge began in 1880 when importers spent the equivalent of $37 million (in 2024 dollars) importing 1,800 metric tons of pan-fired sencha-style tea. Imports rose to $223 million (in 2024 dollars) for a peak of 16,500 metric tons in 1920.

Sales soon dropped sharply due to the imposition of high duties in 1930 under the Smoot-Hawley Tariff Act, which devastated the tea trade for decades, redirecting Japanese tea to Taiwan and Korea, and in Europe, to France and Germany. American hot tea drinkers shifted to Ceylon and Indian black teas. The US primarily purchased low-priced bulk Japanese sencha, which steadily regained market share by volume as a blending tea.

However, it would take another 50 years before matcha outpaced traditional Japanese sencha and bancha, growing at a compound annual rate of 20% from 2015 to 2022. In recent years, premium matcha has accounted for 35-40% of Japan’s US sales by value. Globally, production is estimated at 8,100 metric tons valued at ¥24.5 billion (about $160 million).

Sencha accounts for 50% of Japanese exports by volume. Rising alternatives include hōjicha, a roasted green tea known for its toasty aroma, low caffeine content, and smooth taste. Traditionally consumed as an everyday household tea, hōjicha is now a rising star, accounting for 10% of exports and selling for $15 to $40 per kilo.