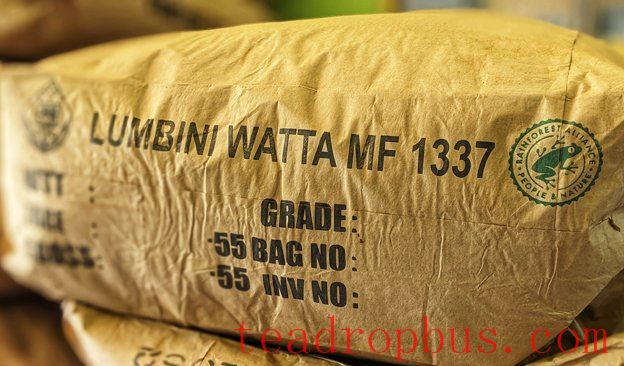

Although some countries have negotiated a reduction in tea tariffs, baseline tariffs remain at 10% and all countries face a July 9 deadline when reciprocal tariffs come back into force. Photo credit: Diana Jendoubi

The mutual decision by China and the US to reduce tariffs for 90 days while negotiating a “new normal” is sufficient to resume trade that was virtually halted as US duties climbed to 152.5% on imported tea.

US Trade Representative Jamieson Greer announced on May 12 that the US rate on Chinese goods would be reduced by 115% to 30%. China agreed to also lower its 125% rate by 115% to 10%. Trump also reduced duties from 120% to 54% on low-value shipments originating in China and Hong Kong. Duties are calculated on the declared value of the shipment. If the amount is under $100 a flat fee of $100 is applied. Trade officials said the flat fee will not increase to $200 in June as previously announced.

The two sides canceled 91% of tariffs on each other’s goods and suspended another 24% for 90 days. During that period, US importers landing Chinese tea will pay 37.5% duties.

Treasury Secretary Scott Bessent said, "The consensus from both delegations this weekend is neither side wants a decoupling.”

Baseline tariffs remain in place for coffee and tea, and all countries face a July 9 deadline when reciprocal tariffs come into force after previously being suspended.

The immediate impact:

Prices are going up. Tariffs will significantly increase the cost of green coffee beans and processed tea for importers and roasters. Consumers will experience inflationary spikes as wholesalers cannot absorb the additional tax.

Independent and small specialty tea and coffee retailers are susceptible to price fluctuations and are concerned that price-sensitive consumers will seek cheaper alternatives.

Trade flows are shifting due to the wide variance in reciprocal tariffs. East African suppliers, for example, face 10% duties while Vietnamese coffee and tea producers face 49% tariffs.

Logistical disruptions inevitable

Importers have seen their landed costs increase overnight. Tea harvested in March and April will soon be on the water. Since tariffs are due as products enter the US, not when they leave their origin, distraught traders are experiencing sticker shock. Importers are expected to pay 25% to 35% more for green coffee and 20% to 50% more for tea.

Compounding these concerns is that the trade war has virtually halted shipments to and from China. Logistics companies report plunging fees, limited service, blank sailings, reduced demand, and higher costs. Shipping containers are piling up at some ports while others report shortages.

The German container shipping group Hapag-Lloyd canceled 30% of China-US-bound shipments, and bookings declined by 25%. Container rates have declined to March 2023 levels.

Jie Shi, an attorney at Huth Reynolds LLP, who represents Fortune 500 US retailers in resolving maritime disputes related to US-China trade and global shipping issues, explains that many tea supply contracts lack clauses addressing tariff risk, leaving buyers and sellers scrambling to renegotiate terms amid narrow margins. “Force majeure is tricky,” she says. Force majeure defenses are unlikely to hold in court without specific provisions, and termination rights may be limited. US importers may consider ending supplier relationships unless products are unique or certified. In the meantime, poorly documented contract changes could result in costly disputes, underscoring the need for formal written agreements in a volatile trade environment, she explains.

Tariff Exemptions

In April 2025, a Presidential Memorandum clarified exemptions for certain products, such as semiconductors, but did not include tea. Advocacy groups continue pushing for relief, citing tea's unique nature and minimal impact on national security concerns.

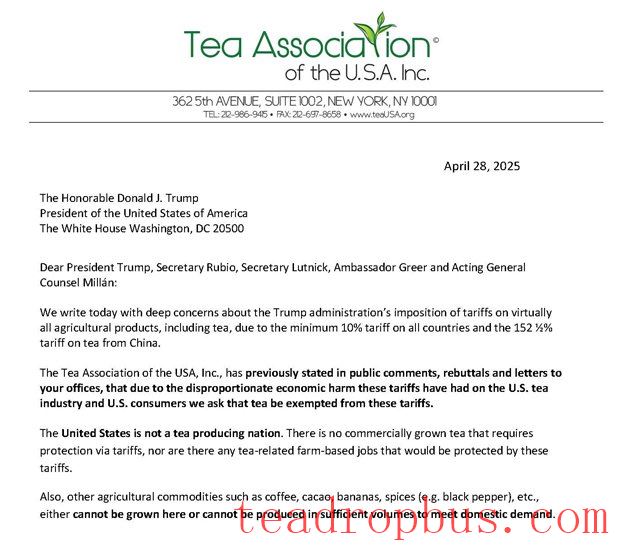

Peter F. Goggi, president of the Tea Association of the USA, said, “The United States is not a tea-producing nation. There is no commercially grown tea that requires protection via tariffs, nor are there any tea-related farm-based jobs that these tariffs would protect.”

“We are recommending that any agricultural product that is not or cannot be grown in the US in sufficient quantities to meet domestic demand also be exempted,” said Goggi.

He appealed to industry leaders to ask federal representatives to “work to exempt tea and other agricultural products.” The letter lists tea, coffee, cacao, bananas, spices, and other crops that cannot be grown here or produced in sufficient volumes to meet domestic demand.

Peter F. Goggi, president of the Tea Association of the USA, appealed to industry leaders to ask federal representatives to “work to exempt tea and other agricultural products.”

President Shabnam Weber writes that the Tea & Herbal Association of Canada, has submitted a remission request on behalf of the industry in Canada.

She provided a link from the Department of Finance detailing Canada’s response to US tariffs.

During the first Trump administration, the US imposed a 15% tariff on Chinese tea under Section 301 (List 4A) effective January 2020. A year later, on Feb. 14, following a coordinated lobbying effort by the Tea Association of the USA and private brands, including Zhejiang Tea Group-owned Firsd Tea in New Jersey, the rates were reduced by half to 7.5%.

Section 301 of the Trade Act of 1974 allows the President to impose tariffs against unfair trade practices when a country’s “acts, policies, or practices are unreasonable or discriminatory.” Tea USA president Peter Goggi succinctly summarized why tea did not threaten trade.

Producers of many agricultural products, such as ginger, faced brutal hardship, leading suppliers to petition for an exemption from the 301 tariffs for specific imports. Letters and testimony followed, and while tea was never exempted, eventually, reduced rates averted the kind of disruption experienced in 2025.

Tea and coffee importers report inspection delays and bureaucratic hurdles arising from market uncertainty, political instability, and rising import fees (including an $18 per net ton charge to land Chinese cargo in addition to tariffs). The docking charge rises to $50 per net ton in October and will then increase by $30 a year over the next three years to $140/net ton.

“Imposing tariffs on all imported teas will not impact the producers, exporters, or governments. However, it will negatively impact the American consumers,” writes Goggi.